Earlier this week, Amazon.com Inc., JPMorgan Chase & Co., and Berkshire Hathaway Inc. jolted Wall Street with their announcement of a joint venture designed to reduce health care costs for their combined one million US employees. It is exciting to see innovative private sector companies lend their intellectual and financial capital to a seemingly intractable issue that has plagued the American economy for decades. About 18 percent of our nation’s financial output is now devoted to health care. For decades, health care costs have outpaced overall economic growth, and the gap is projected to remain to remain at three percentage points a year.

How the High Cost of Care Affects Employers – and Everyone Else

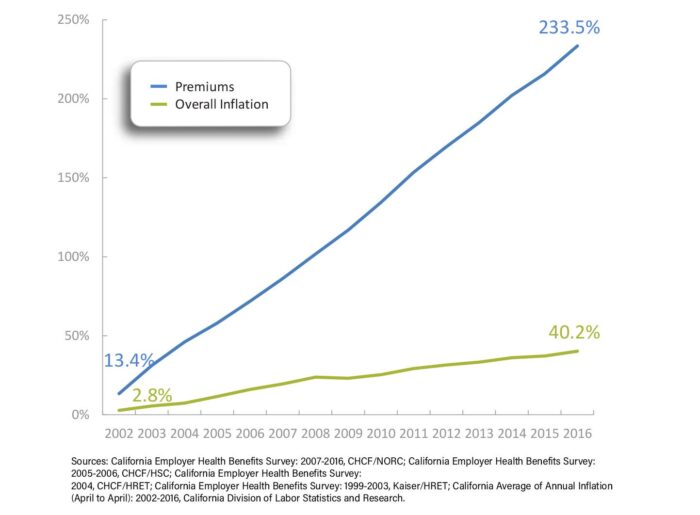

Employees directly and indirectly shoulder these costs. The average premium (PDF) that employers and their workers pay for a family plan in California now exceeds $1,600 a month. Employer-based family health insurance premiums in the state have increased by 234% over the last 15 years, nearly six times the increase in the state’s overall inflation rate. Every dollar spent on health care is a dollar unavailable for something else, such as education, affordable housing, and environmental protection.

Cumulative Premium Growth Compared to Inflation – Family Coverage, California, 2002 to 2016

Sixty-six percent of working California families face a deductible of $2,000 or more for their employer-based coverage, including many without high-deductible health plans linked to tax-advantaged health savings accounts.

Increasingly, health care is unaffordable for all of us—not just businesses like Amazon and its workers, but for retirees, the self-employed, people seeking employment, and Californians with low incomes who aren’t eligible for public coverage. The Affordable Care Act (ACA) attempted to address the cost burden for those with employer coverage by creating disincentives for employers to simply pass on unaffordable premiums, and by capping the share of premiums health plans spent on overhead and profit. For people who shop for insurance coverage on the individual market, the ACA provided federal tax credits to offset premium and cost sharing.

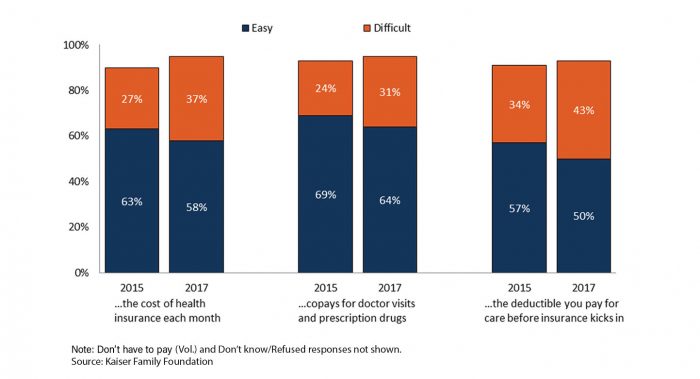

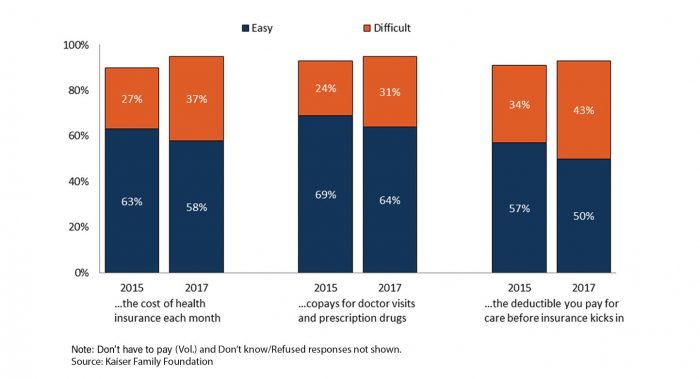

While these and other efforts have helped, more work is needed. Too many families still struggle to afford health care. In 2017, 37% of Americans with health insurance found it difficult to afford premiums each month. Forty-three percent said it was hard to meet their deductibles before coverage kicked in. Among California workers with an aggregate family deductible, 66% faced a deductible of $2,000 or more in 2016.

At least 40% of adults say they worry about being able to afford health care services, losing their insurance, or being able to afford prescription drugs.

More Insured Americans Now Report Difficulty Affording Health Care

What We Already Know About Reducing Health Care Costs

Addressing the affordability of care in California and throughout the country requires lowering the underlying cost of care across market segments. Many efforts are already underway. Health insurance companies, large self-funded employers, and public purchasers of care often deploy management strategies to reduce the use of expensive tests, high-cost prescription drugs, and duplicative services. The most common strategies include prior authorization, patient education for better clinical decisionmaking, chronic disease initiatives, and pushing the cost to employees through deductibles and other cost-sharing tools.

To date, the results of these initiatives have been mixed. The findings are consistent with a growing body of academic research that suggests the real driver of health care costs is price, not increased demand. If that is the case, the solution might be to create a market that rewards high-value providers and cost-effective drugs. This type of strategy would rely on tools like reference pricing (individual drugs are grouped by therapeutic class and payment is limited to the price of the cheapest drugs in each class), value-based insurance design (copayments are reduced or eliminated for the most efficient, effective services), or high-deductible health plans.

Unfortunately, consumer-driven approaches have also had limited impact. While companies like Amazon might develop new technologies to enable patients to easily compare, shop for, and purchase health care services in a competitive marketplace, to date these types of tools have not succeeded in reducing costs or changing provider behavior in California. More to the point, introducing blunt consumer-facing financial incentives may run counter to the overall goal of affordability. Everyone should have access to the care they need at a price they can afford and not face care that is rationed by their ability to pay for it.

The Promise of Scale

Perhaps the biggest advantage of the new joint venture is its size and reach. The most promising solutions today are found in large, integrated delivery systems. They have consistently shown that the best approach is to give providers simple, strong financial incentives to make care more efficient and effective. Because this type of model works best on a large scale, the ideal approach is for multiple public and private purchasers of care to come together to align quality reporting requirements, reward value, and support investments in improving health outcomes across entire groups of people. We are already seeing this happen in California and other states.

No one group or slice of the private health care market has the power to really drive down health care costs for everyone. It will take many, many players in the private and public sectors working together to align their efforts. The foundation of payment and delivery reform laid by the Affordable Care Act is a good place to start. Technology is critical and necessary – but it is not by itself sufficient. Leaders also need to pull policy levers, fix payment systems, and spark collaboration between purchasers. Innovators like Amazon, JPMorgan Chase, and Berkshire Hathaway will no doubt make material contributions. Their leadership, in tandem with that of other large purchasers, offers a prime opportunity to make care more affordable for everyone.

Authors & Contributors