Many Californians know that Medi-Cal is our state’s health coverage program for residents with low incomes, including children, people with disabilities, and workers who may not get affordable health insurance through their jobs.

What many Californians don’t realize — call it Medi-Cal’s best-kept secret — is that even with the program’s rising enrollment and costs in recent years, Medi-Cal’s financial impact on our state’s General Fund (the account that receives most state tax revenues) has been relatively small. This matters because General Fund dollars support an array of vital services in addition to Medi-Cal, many of which — such as income supports and subsidized childcare for working families with low incomes — also promote Californians’ health and well-being. If Medi-Cal had claimed a larger share of General Fund revenues over the past decade, fewer state dollars would have been available to support other critical public supports and services.

This article first looks at how our state has expanded Medi-Cal to meet the health care needs of one in three Californians while minimizing the program’s impact on the General Fund. It then highlights key Medi-Cal financing issues on the horizon that could hamper state policymakers’ efforts to continue balancing Medi-Cal’s funding needs with those of other important public services. This article is adapted from a presentation I gave at the February 25 Medi-Cal Explained briefing hosted by the California Health Care Foundation.

As Medi-Cal Enrollment Doubled, State General Fund Support Rose Modestly

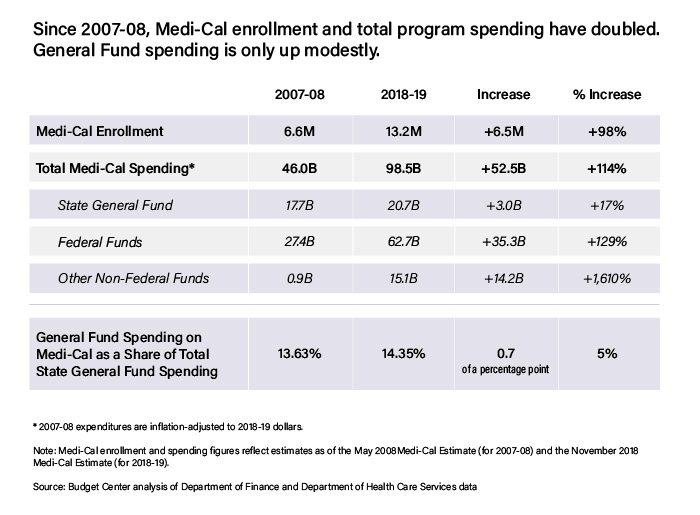

Medi-Cal, California’s Medicaid program, has seen enrollment and expenditures grow substantially since 2007–08 (PDF), the last fiscal year before the Great Recession sent California’s economy and state budget into a tailspin. Enrollment for the current fiscal year (2018–19) is expected to be 13.2 million, about double the 2007–08 level. Total Medi-Cal spending is anticipated to reach $98.5 billion, roughly $53 billion (114%) higher than in 2007–08. (All 2007–08 expenditures are adjusted for inflation.)

State General Fund dollars accounted for only $3 billion of this $53 billion increase in Medi-Cal spending between 2007–08 and 2018–19. This relatively small jump in General Fund support for Medi-Cal is remarkable in light of periodic concerns that the program is putting the squeeze on California’s General Fund budget. Instead, Medi-Cal’s spending growth has largely been supported with non-General Fund sources of revenue. Specifically, the remainder of the $53 billion spending increase between 2007–08 and 2018–19 — around $50 billion — came from federal funds ($35.3 billion) and other non-federal funds, such as state taxes paid by managed care organizations (MCOs) and fees paid by hospitals ($14.2 billion). Since 2007–08, federal funding for Medi-Cal has increased by 129%, while other non-federal funds have grown by more than 1,600%.

The substantial increase in non-General Fund support for Medi-Cal has been driven by several factors, including:

- More generous federal cost-sharing. California and the federal government equally split the cost of services for most Medi-Cal enrollees. However, the Affordable Care Act (ACA) included more generous federal cost-sharing for certain beneficiaries. The federal government pays 93% of the cost for the Medi-Cal expansion population, which consists of nonelderly adults with low incomes who became newly eligible in 2014. In addition, federal dollars fund 88% of the cost for children who are enrolled in Medi-Cal as part of the Children’s Health Insurance Program (CHIP). Like a see-saw, higher federal cost-sharing leads to lower state cost-sharing, freeing up state General Fund dollars.

- Creative financing. California has tapped into alternative in-state financing sources to support Medi-Cal, including local matching funds (such as from counties and public hospital systems), provider fees, and a tax on MCOs. These alternative sources of financing allow California to draw down more federal funding for Medi-Cal while minimizing the impact on the General Fund.

- The 2016 state tobacco tax increase. Proposition 56 raised the state’s excise tax on cigarettes by $2 per pack and triggered an equivalent increase in the state tax on other tobacco products. Medi-Cal’s share of these revenues — roughly $1 billion per year — is primarily used to boost payments to doctors and other Medi-Cal providers, relieving the need for the General Fund to support such rate increases.

What about General Fund support for Medi-Cal as a percentage of the total General Fund budget? Medi-Cal’s share of the General Fund has increased by just seven-tenths of a percentage point over the past decade — from 13.63% in 2007–08 to an estimated 14.35% in 2018–19. Yes, Medi-Cal receives a slightly larger slice of the General Fund “pie” than it did 2007–08. But this increase has been modest given the substantial benefit experienced by millions of Californians newly covered by the program. As a result, more state dollars have been available for other public services and systems than if General Fund support for Medi-Cal had risen at a much faster pace.

Medi-Cal’s Big Financing Issues Create Uncertainty for Medi-Cal and the General Fund

Over the past decade, state policymakers have deftly balanced the needs of a growing Medi-Cal program with those of other public services and systems. However, Medi-Cal faces a number of near-term financing issues that could make this balancing act more challenging in the coming years. These financing issues include:

- Reductions in federal cost-sharing. The federal government is scheduled to reduce its share of costs for CHIP-funded children as well as for adults enrolled in Medi-Cal starting in 2014 under the ACA. The state’s share of CHIP costs will increase in two steps, rising from 12% to 23.5% on October 1, 2019, and then to 35% on October 1, 2020. For the expansion population, the state’s share of cost will rise from 7% to 10% on January 1, 2020, where it will remain unless revised by Congress. Upon full implementation, these changes will increase annual state General Fund spending on Medi-Cal by more than $1 billion compared to 2018–19, according to estimates from the state’s nonpartisan Legislative Analyst’s Office (LAO).

- The pending expiration of the MCO tax. California’s MCO tax expires on June 30, and Governor Gavin Newsom is not proposing to extend it. If the MCO tax expires, California would forgo a net annual General Fund benefit of $1.5 billion, based on the current structure of the MCO tax package. These dollars could help to pay for a number of state policy advances, including efforts to move California closer to universal health coverage. The governor “has not laid out a convincing rationale” for declining to seek an extension of the MCO tax, according to the LAO. If the tax were allowed to expire, annual state General Fund costs for Medi-Cal would ultimately increase by well over $1 billion but without any additional benefit to the Medi-Cal program. Instead, state General Fund dollars would simply replace lost MCO tax revenues in order to keep the program whole.

- The pending expiration of two major federal waivers. California’s current Section 1915(b) waiver expires on July 1, 2020. Under this waiver, counties are allowed to deviate from standard Medicaid rules and provide or arrange for a broad array of “specialty mental health services” for eligible Medi-Cal beneficiaries. In addition, California’s Section 1115 Medi-Cal 2020 waiver expires at the end of 2020. Under this waiver, the federal government is providing the state with billions of dollars to help improve access to care as well as to transform how care is delivered. Will the Trump administration agree to renew these waivers without significantly reducing federal funding or imposing new requirements that California would find objectionable? Time will tell.

- The next recession. Medi-Cal could face spending cuts when the next recession comes and policymakers seek ways to close budget shortfalls. Fortunately, California has been building up its reserves. The state expects to have more than $15 billion in its constitutional reserve, the Budget Stabilization Account, by the end of 2019–20. In addition, Governor Newsom wants to add $700 million to the state’s new Safety Net Reserve for Medi-Cal and CalWORKs. (The balance now is $200 million.) These reserves will reduce the need for state budget cuts during the next downturn, although Medi-Cal would not be guaranteed a specific share of the funds. State reserves will be crucial to shoring up Medi-Cal’s budget because the federal government may do little to help states pay for their rising Medicaid costs when the next recession arrives.

One of the biggest challenges — and opportunities — that California lawmakers and the governor face each year is allocating the state’s limited General Fund revenues among many vital priorities. The financing issues that Medi-Cal is facing — and how these issues are resolved — will help to determine whether policymakers can continue improving the Medi-Cal program while also ensuring that other vital public services are adequately funded.

Authors & Contributors

Scott Graves

Scott Graves is director of research for the California Budget & Policy Center. He oversees the budget center’s analytical work, conducts research and analysis related to health and human services and corrections, and is the organization’s lead analyst on the state and county budget processes.

Scott received a bachelor’s degree in government and journalism from California State University, Sacramento, and a PhD in political science from the University of Texas at Austin.