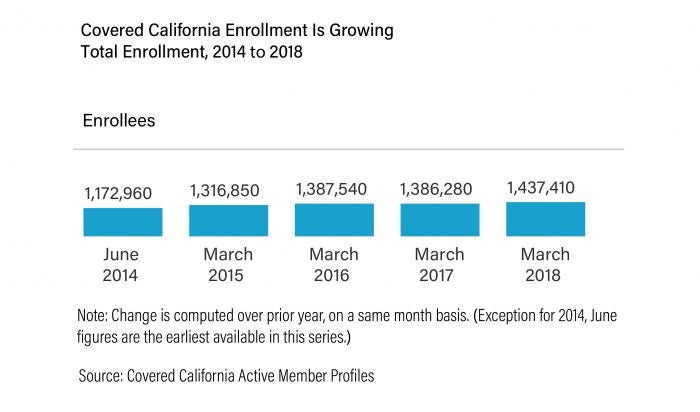

Enrollment in Covered California health plans grew 3.7% in the 12 months ending March 31, 2018, reaching 1,437,000 members.

[efn_note]This calculation is based on preliminary data that are subject to revision as noted in Covered California’s Active Member Profile (March 2018), released April 24, 2018.[/efn_note]

The strong year-over-year growth occurred despite federal efforts to eliminate cost-sharing subsidies and weaken the Affordable Care Act’s individual market coverage.

The recent open enrollment season also drove big shifts in health plan market share, and doubled membership in gold plans.

The Trump administration’s decision to stop cost-sharing reduction (CSR) payments for enhanced silver coverage beginning in 2018 coupled with California’s surcharge workaround, described below, changed plan selection incentives for many people, especially those without premium subsidies. These changes contributed to a two-fold increase in gold tier enrollment, modest increases in the bronze tier, and reductions in the silver tier.

To ensure that lower-income consumers in California maintained the reduced out-of-pocket costs provided by CSRs, the CSR cost was loaded into Covered California silver plan premiums as a surcharge. Since federal premium subsidies increase with rising premiums, most consumers who qualified for subsidies were therefore protected from having to pay more for silver plans, while still benefiting from lower cost sharing. Because Covered California customers receiving premium subsidies can use them to purchase plans at any metal tier, and because gold plans, which have more generous coverage than silver plans, included no “surcharge,” these plans became more attractive for many. Silver plans became more expensive for people who bought Covered California plans while ineligible for premium subsidies.

More Gold and Bronze

Twice as many enrollees as in 2017 chose gold this year. Gold covered 10% of enrollees, up from 5% in 2017, for a total of 147,000 customers in 2018. Substantial increases in gold-tier enrollment occurred in both subsidized (from 3.8% to 9.3% of enrollees) and unsubsidized (from 12% to 17% of enrollees) plans.

Overall, bronze coverage expanded modestly from 27% to 29% of enrollment, an increase of about 44,000 people. Among people without subsidies, increases in bronze enrollment were substantial, making bronze by far the most common choice in 2018. Bronze concentration rose from 38% of enrollees in 2017 to 47% in 2018 — nearly half of all unsubsidized coverage. Among subsidy-eligible enrollees, the concentration of bronze coverage shifted only slightly, from 25% to 27%.

Reductions in silver-tier enrollment occurred across the board but were sharpest among people ineligible for subsidies. The silver share of unsubsidized enrollees fell from 37% to 23%, meaning that about 38,000 silver enrollees paid the full surcharge. Among enrollees with subsidies, the share choosing silver plans fell from 68% to 61%.

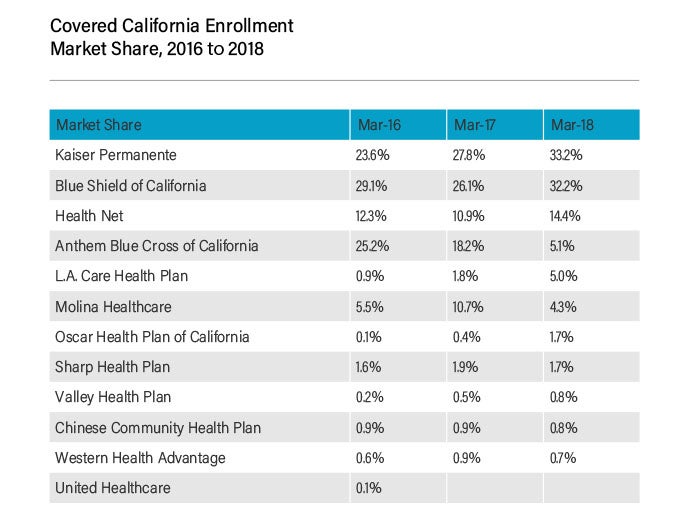

Big Shifts in Health Plan Market Share

The 2018 enrollment period led to major changes in health plan market shares, as Anthem withdrew from most regions and consumers digested premium changes. When the dust settled, Anthem and Molina’s market shares had declined, while Blue Shield, Kaiser, Health Net, and L.A. Care had gained substantial market share. Blue Shield and Kaiser each emerged with one-third of the market.

The change was most dramatic for Anthem, with market share sliding from 18% in 2017 to 5% this year. That’s a loss of 179,000 customers. As recently as March 2015, Anthem covered more than one of every four enrollees. For 2018, Anthem withdrew from 16 of the 19 Covered California regions, leaving Blue Shield as the only universally available health plan option offered by the state’s health plan marketplace.

Molina lost 87,000 enrollees in 12 months, and market share fell from 11% to 4%. In 2017, Molina was the lowest-priced product in each of the six regions where it was offered, but the company reported it was losing money. With steep premium increases in 2018, Molina was no longer the lowest or even second-lowest option in five of its six regions.

On the other side of the equation, Blue Shield, Kaiser, Health Net, and L.A. Care made substantial gains in market share. Blue Shield and Kaiser added about 100,000 enrollees and Health Net some 50,000. Blue Shield and Kaiser each finished the first quarter with about one-third of the market. Kaiser’s share expanded from 28% to 33%, and Blue Shield’s grew from 26% to 32%. L.A. Care saw its market segment rise from 1.8% to 5%, nearly tripling enrollment to 72,000. Although still small statewide, Oscar Health Plan also made a significant gain, from 6,000 to 25,000 enrollees.

Authors & Contributors

Katherine Wilson

Katherine Wilson is an independent consultant specializing in health insurance markets and health care costs. She is the author of numerous publications and reports, including CHCF’s series of reports on California health insurers.